Blockchain / Cryptocurrency

China’s ubiquitous digital payments processor loves the blockchain

Ant Financial has several blockchain-powered applications, despite being based in a country that frowns on some aspects of the technology.

China’s government is no fan of cryptocurrency. It has banned cryptocurrency trading and initial coin offerings, and may even kill off its massive crypto-mining industry. On the other hand, it’s supported the development of applications based on the blockchain technology that underlies digital currencies like Bitcoin. That’s helped trigger an explosion of blockchain-related projects in the country.

Leading the way is Ant Financial, the biggest financial technology company in the world by value.

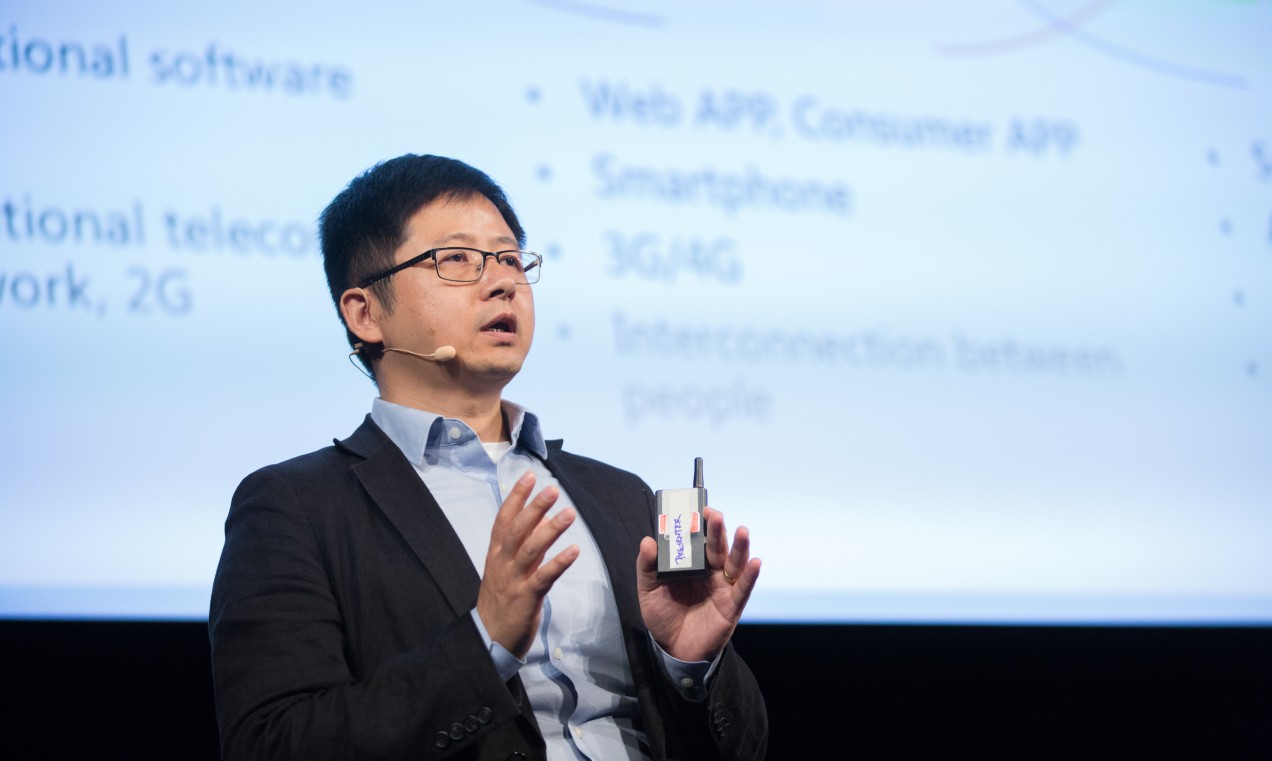

An affiliate of the e-commerce conglomerate Alibaba, Ant Financial operates the digital payment service Alipay, which is ubiquitous in China. It’s also been investing heavily in cutting-edge technologies—among them artificial intelligence, quantum computing, and, yes, blockchain. A major goal of this high-tech initiative is to build the “industrial internet,” Hui Zhang, director of Ant Financial’s blockchain division, told the audience at MIT Technology Review’s Business of Blockchain event yesterday.

Despite the fact that 600 million Chinese consumers have come online in the past decade, digital services tailored to Chinese industry have a lot of catching up to do, he said. Blockchain technology, in combination with the internet of things and artificial intelligence, will give companies a more efficient way to connect and exchange valuable data and thereby boost their productivity, Zhang said. “We need a better collaboration network,” he said, and Ant Financial believes blockchain technology will be crucial to that.

The firm, which in 2018 was valued at $150 billion, has developed a proprietary blockchain platform. Alibaba was the world’s leader in patents amassed in 2018, just ahead of IBM (China’s central bank was in 4th place). Ant Financial is already using the technology to support several applications: one that tracks charity donations (around $50 million so far), one for tracking physical items like components of a supply chain, and a third that facilitates rapid cross-border payments in Asia. It’s also building a blockchain-based platform for international trade finance.

In addition to working on its proprietary technology, Ant Financial is also developing applications for the open-source enterprise blockchain platform Hyperledger as well as a private version of Ethereum.

Zhang said the company is exploring how to issue digital assets in “some form of a token” on the blockchain that would represent something of value in the physical world—whether that be fiat currency or some other kind of asset.