Blockchain / Bitcoin

Bitcoin is eating Quebec

A Canadian hydropower operation put out the welcome mat for bitcoin miners. Shortly thereafter, it was overrun.

At first glance, nothing looks particularly cutting-edge about this aging industrial park in Saint-Hyacinthe, Quebec, about 60 miles east of Montreal. The air is thick with the smell of roasting cacao, which billows from a massive chocolate factory and seeps into tractor-trailers and forgotten offices. Nearby, an audiovisual repair shop and an agricultural lab specializing in the detection of livestock pathogens vie for space with a massive disused dairy processing plant. Tucked behind all three sits a worn, low-slung building that previously served as a warehouse for a soup company and, before that, a factory producing diapers. You might think it, too, had since been forgotten, were it not for the plastic sheeting hinting at new construction inside and the small fleet of shining company cars stationed in the parking lot. But the biggest clue of all that something both new and decidedly high-tech is happening here can be heard while standing next to those cars: an omnipresent hum, audible well outside the building, created by thousands of computers, each one completing the same singular task again and again and again, day after day, without change or interruption.

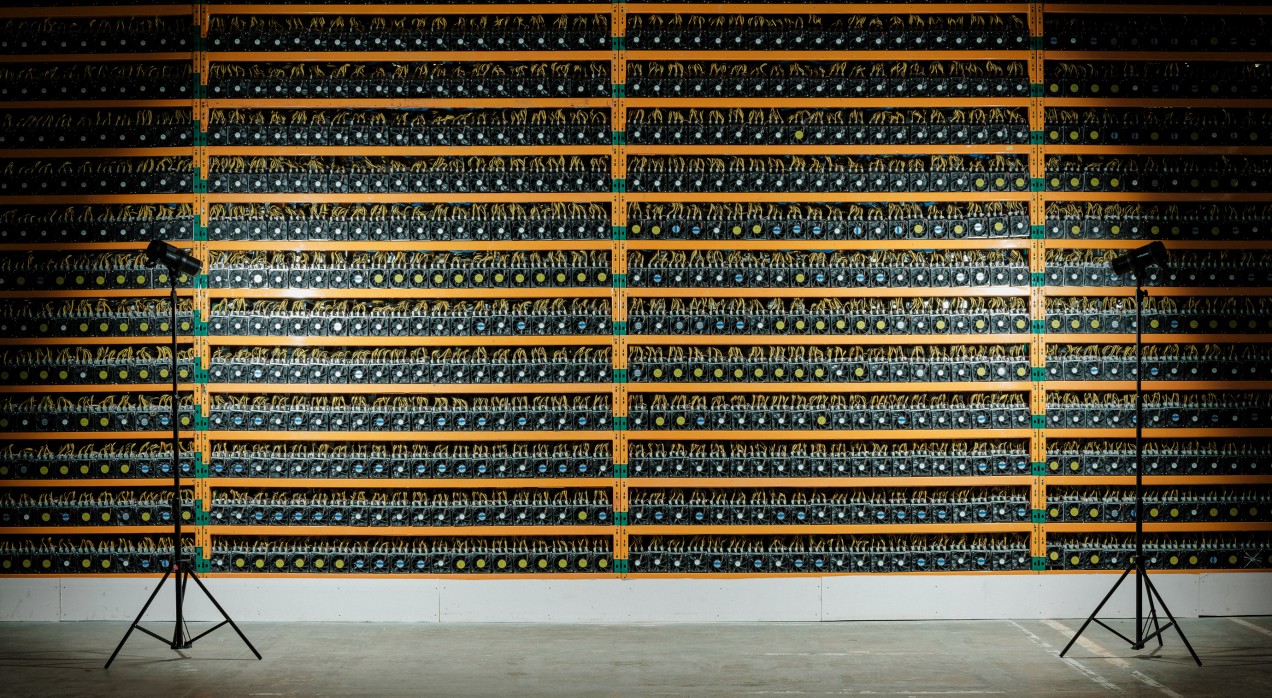

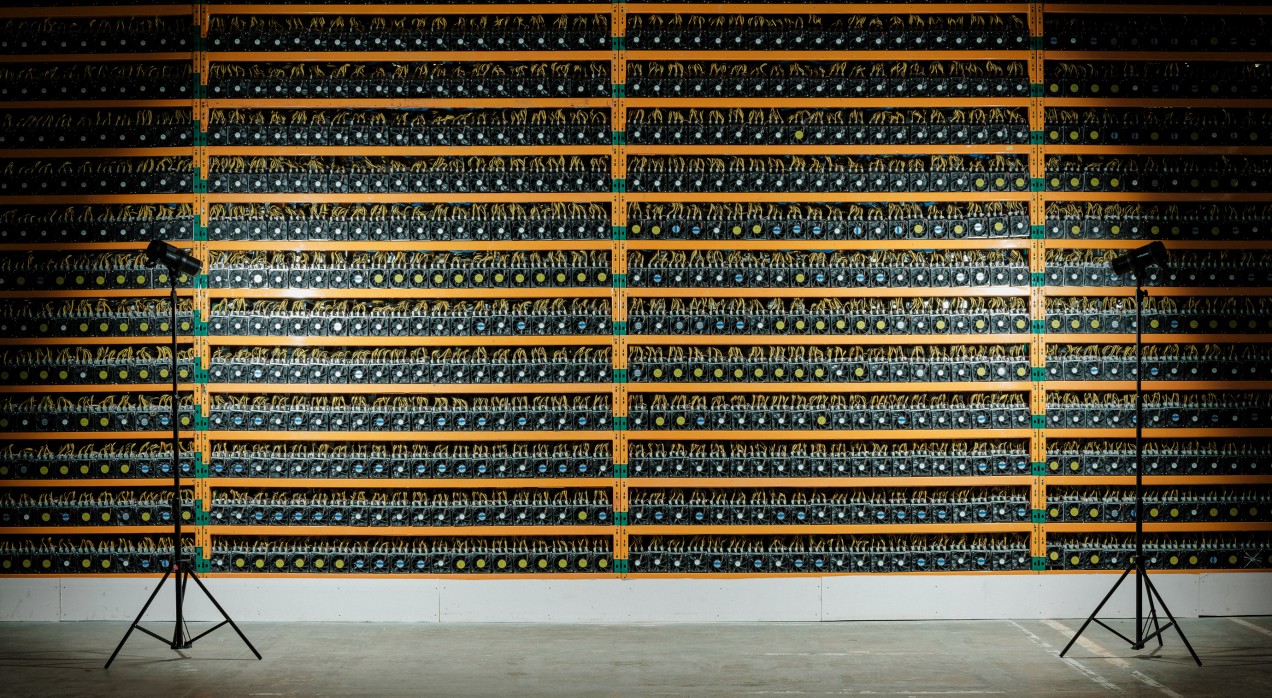

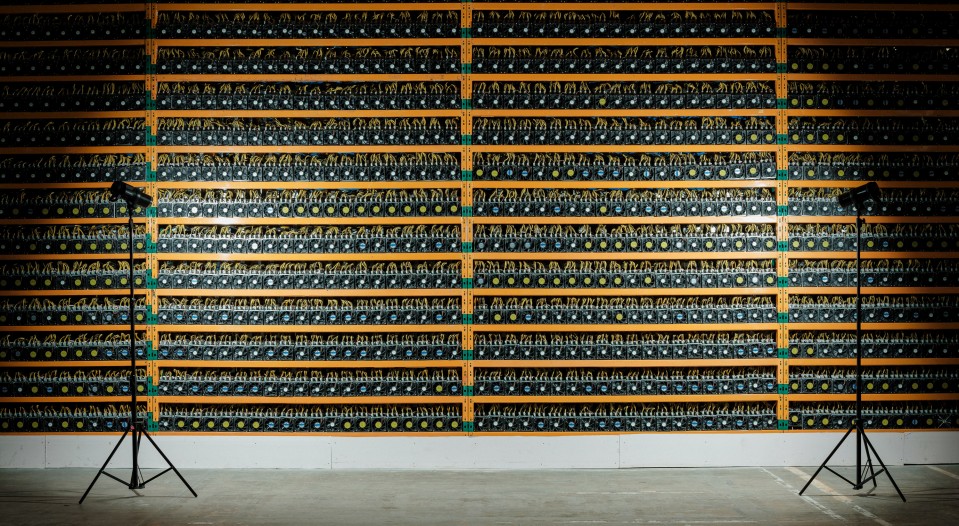

These computers are the property of Bitfarms, one of North America’s largest cryptocurrency mining operations. Here in the once-abandoned factory, about 7,000 shoebox-size machines (as of April, but that’s expected to rise to 14,000 by July) sit tightly shelved in a single floor-to-ceiling row that bisects the building. On one side of the stacks, a mess of wires and routers exiting the rear of each computer sits exposed to the cold Canadian air. On the other, thousands of identical fans roar as they push hot air past a heap of empty cardboard boxes and into the otherwise vacant space. A handful of busy employees move between the two sides wearing thin T-shirts and jeans, their faces flushed. Even on a raw, gray day, the heat on the fan side is stifling.

These computers, often called “rigs,” are purpose-built. Able to withstand dramatic shifts in temperature and humidity, they are singularly programmed not only to perform just one computation trillions of times each second, but to repeat those computations around the clock and without pause. They are also energy hogs: the 7,000 in Saint-Hyacinthe alone consistently draw more energy than the Montreal Canadiens’ nearby hockey arena, even on a sold-out game night.

Globally, millions of these computers are in operation, part of the cryptocurrency boom that began in 2009. In the decade since the inception of Bitcoin, most of this mining work has occurred in countries like China and Romania, which offer plentiful electricity and little regulation. In 2016, Hydro-Québec announced a formal plan to woo data centers like those run by Microsoft and Amazon. Cryptocurrency miners also came calling, and began submitting proposals in September 2017. Interest from them soon became overwhelming, with more requests than the power company could accommodate. Were Quebec to accept even a fraction of them, the province could well become the new global hub of cryptocurrency mining. That has raised questions about how well Hydro-Québec’s grid can sustain these energy demands, particularly in the winter. Meanwhile, environmentalists and social-justice advocates worry about the ecological and cultural impact of this campaign. And that, in turn, raises difficult ethical questions about the real value of a wholly virtual currency.

Worthless puzzles

Cryptocurrencies are energy-intensive by their very nature. As decentralized ledger systems, of which Bitcoin is the largest, most rely for their security on an approach known as “proof of work.” About every 10 minutes, Bitcoin releases new currency in exchange for successfully solving computational problems that verify a “block” of transactions. Participants do this by converting the data representing those transactions into a sequence of code known as a “hash,” trying again and again until they arrive at one that meets certain criteria. And while it doesn’t require an immense degree of sophistication—insiders liken the process to guessing lottery numbers—it does require an immense quantity of wrong guesses.

“You’re essentially solving worthless puzzles that we cannot solve mathematically,” says Christian Catalini, associate professor of technological innovation at MIT and founder of the university’s Cryptoeconomics Lab. “You can only brute-force your way into it.” And the muscle behind that force comes in the form of electricity used to power miners’ computers.

Resource intensiveness is inherent in a decentralized system like Bitcoin’s, says Catalini, because it is based on a fundamental lack of trust between participants. Instead of being guaranteed by a central bank like, say, the US Federal Reserve, cryptocurrencies like Bitcoin combat fraud by making all transactions transparent and verifiable by all participants. Attempts to tamper with such a ledger must be made self-defeating.

“Basically, you’re placing an economic cost between a user and an attacker,” says Catalini. “If someone wants to subvert the system by faking a transaction, or revert a legitimate transaction, they would have to expend a tremendously high amount of energy and computation—to the point that no rational economic actor would do that, because the cost of doing an attack would be far greater than the benefit.”

But that means legitimate transactions must also expend extensive energy to prove their validity.

David Malone is a senior lecturer at Ireland’s Maynooth University, where he specializes in the mathematical modeling of network systems. The current global Bitcoin hash rate, which is to say the total number of mining computations, is approximately 25,000,000,000,000,000,000 per second, or 25 million terahashes a second. That’s an increase from 300,000 terahashes a second just four years ago, and the figure is expected to continue growing in the months and years to come. Factor in additional energy consumption required to cool the computers (they can’t function in temperatures over 40 °C), and Malone estimates that Bitcoin alone is consuming as much electricity as the entire nation of Ireland at any given moment. And while Bitcoin is the largest proof-of-work cryptocurrency, it’s far from the only game in town: at last count, there were nearly 1,500 in operation, each with its own energy demands.

Without a doubt, electricity is the single greatest expense for any mining operation. And so, to be profitable, farms must be able to source power on the cheap. That’s a big reason why China has led the mining boom: its electricity rates are, in some locations, as low as three cents per kilowatt-hour. But increasing government regulation and concern that grid resources could run out have many miners there looking for other places to set up shop. Growing concerns about China’s contribution to climate change only hastened that exodus, as mining companies sought to promote their operations to potential investors as environmentally friendly.

For years now, China has led the world in greenhouse-gas emissions. That’s partly because it is the most populous nation. However, it’s also because China generates most of its electricity using coal, which is one of the dirtiest forms of energy. The United States, currently the second most popular country for cryptocurrency mining, also gets the majority of its electricity from fossil fuels. Add in the rest of the mining operations around the world, and the industry emits about 29,000 kilotons of carbon a year, according to Digiconomist, the leading clearinghouse of cryptocurrency and energy concerns. That’s more than is produced annually by Afghanistan, Croatia, Kenya, or Panama.

It’s also a big reason why Pierre-Luc Quimper, the founder of Bitfarms, located all five of his mining operations in Quebec, where he could rely on hydropower to fuel his 20,000 computers. Quimper and his colleagues at Bitfarms had been involved with cryptocurrency in a variety of capacities since 2009. They joined forces and established both the company and their mining facilities in late 2017—just in time for the Quebec boom.

“We use a lot of energy,” says Quimper. “It has to be clean. If we have a footprint on the environment, that’s bad.”

Hydro-Québec touted its hydroelectric power as the ideal solution: a clean, renewable source of energy that can be supplied in massive quantities. It contends that the energy it provides to cryptocurrency mining operations is “surplus”—an extra 100 terawatts of low-impact energy the utility has the capacity to generates over the next decade.

But the claim that this energy is green has come under increasing scrutiny, particularly from conservation biologists. They say the impact is far too high for any additional industry, let alone one that produces nothing but bitcoins.

Millions of acres under water

Hydroelectric power, which uses moving water to turn turbines that generate electricity, is undeniably cleaner than coal and other electricity generated by fossil fuels. Nevertheless, it, too, produces demonstrable environmental impacts. One of the biggest is the damage created by the reservoirs built to hold a ready supply of water. In places like Quebec, these reservoirs often overtake existing forests, which are some of the planet’s most efficient converters and bankers of carbon. And as trees rot underwater, they release the carbon they’ve stored as methane—a far more potent greenhouse gas than carbon dioxide.

“You’re putting hundreds of thousands and eventually millions of acres under water,” says Jeff Wells, a conservation biologist and researcher at Cornell University. He was the lead author of a 2011 study into the effects of industrialization on northern forests. “You’re putting a greenhouse gas in the atmosphere and stopping the ability of that area to take any more carbon into the system,” he adds. “You’ve lost a whole ecosystem.”

Researchers have calculated the carbon impact of hydroelectricity worldwide. Their estimates suggest that if all cryptocurrency mining were to move to this power source, the industry would still generate over 9,000 kilotons of carbon dioxide each year, plus more than 150 kilotons of methane.

And while hydroelectric operations in cooler climates tend to release less carbon and methane than their tropical counterparts, they come with their own unique environmental price tags. The northern ecosystems known as boreal forests don’t just sequester carbon. Their rivers supply the water that forms the bulk of Arctic sea ice and are believed to be responsible for key ocean currents that transport water and define global weather patterns. Because dams like the ones maintained by Hydro-Québec tend to be far away from population centers, they also require extensive installations of transmission lines and transformers. Those, in turn, can disrupt wildlife habitats, kill birds, and introduce invasive species.

Marc-Antoine Pouliot, a spokesperson for Hydro-Québec, assured me that full environmental impact studies are completed before any new dam construction is begun. He said the utility runs a complete analysis of any new blockchain operation, and if any updates to the grid are required, the company is responsible for funding them. The only concern, he said, is how to manage the constant energy draw of these operations during existing peak usage times—like Canadian winters.

“In Quebec, residential customers heat their homes with electricity. In consequence, the demand can be very high when the temperature is below -20 °C for a few days,” he said. “We are now analyzing the effect of the blockchain on our winter peak. One of the solutions could be to oblige blockchain companies to suspend the activity during the winter.”

In an industry where every day can be worth tens of thousands of dollars or more, it remains to be seen whether outside miners would be amenable to that kind of solution.

Wells would like to see fewer massive dam complexes, not more. “I already start off with the idea that it’s not a good idea to destroy a working system that is literally part of the life support of the planet,” he says. “There are fewer and fewer of those places left. To do it for cryptocurrency or some speculative technology seems completely reckless.”

But miners like Quimper take issue with the idea that cryptocurrency is unproven or a passing experiment. Blockchain, he says, like network servers and the internet itself, is clearly here to stay. And fueling it with hydropower remains the most environmentally responsible way to meet the skyrocketing interest in applications like cryptocurrency. He points to additional benefits provided by companies like his: Bitfarms’ five operations each reclaimed otherwise abandoned and decaying warehouses and factories in communities throughout Quebec. They’ve injected resources into the local economy and employed residents to work there.

And more innovation, he promises, is on the horizon to further offset carbon emissions.

Not far from the Bitfarms Saint-Hyacinthe mining operation, a small startup company called K.E. Inc. is looking to change where and how cryptocurrency is mined in North America. Its founder, Fooad Nejad, cut his teeth in cooling systems for data centers. When new mining operations began contacting him to create efficient cooling for their farms, he developed self-contained modular shells that can accommodate up to 1,200 computers. The computers still require the same amount of energy, says Nejad, but a recirculating ventilation system cuts down on heating and cooling needs. The pods, which resemble shipping containers, can be set up anywhere and don’t require retrofitting or other costs associated with rewiring old buildings. They can also be easily adapted to channel the heat produced by the computers. Nejad says it’s not a stretch to imagine them heating buildings or allowing greenhouses to grow warm-weather crops like tomatoes and strawberries year-round, even in Quebec.

Empty cardboard boxes

So just how big an impact will blockchain applications like cryptocurrency continue to make on our planet? That depends on whether future blockchains continue to use the energy-devouring proof-of-work approach.

One alternative is known as “proof of stake.” Rather than asking people to solve resource-intensive computational puzzles, a proof-of-stake system requires issuers to put up capital as a guarantee. Late last year, the blockchain consortium Ethereum announced plans to convert to a proof-of-stake system for its cryptocurrency mining. If successful, it will be the first of its kind and could well lead to an industry shift away from proof of work.

But until then, operations like Bitfarms continue to grow. Those heaps of empty cardboard boxes back at the Saint-Hyacinthe former diaper factory? They're packaging from all the new computers the company has added to its operations.

Kathryn Miles is a freelance writer and the author of four books, including Quakeland: On the Road to America’s Next Devastating Earthquake.