Business Impact

Can China and the Internet Save American Small Business?

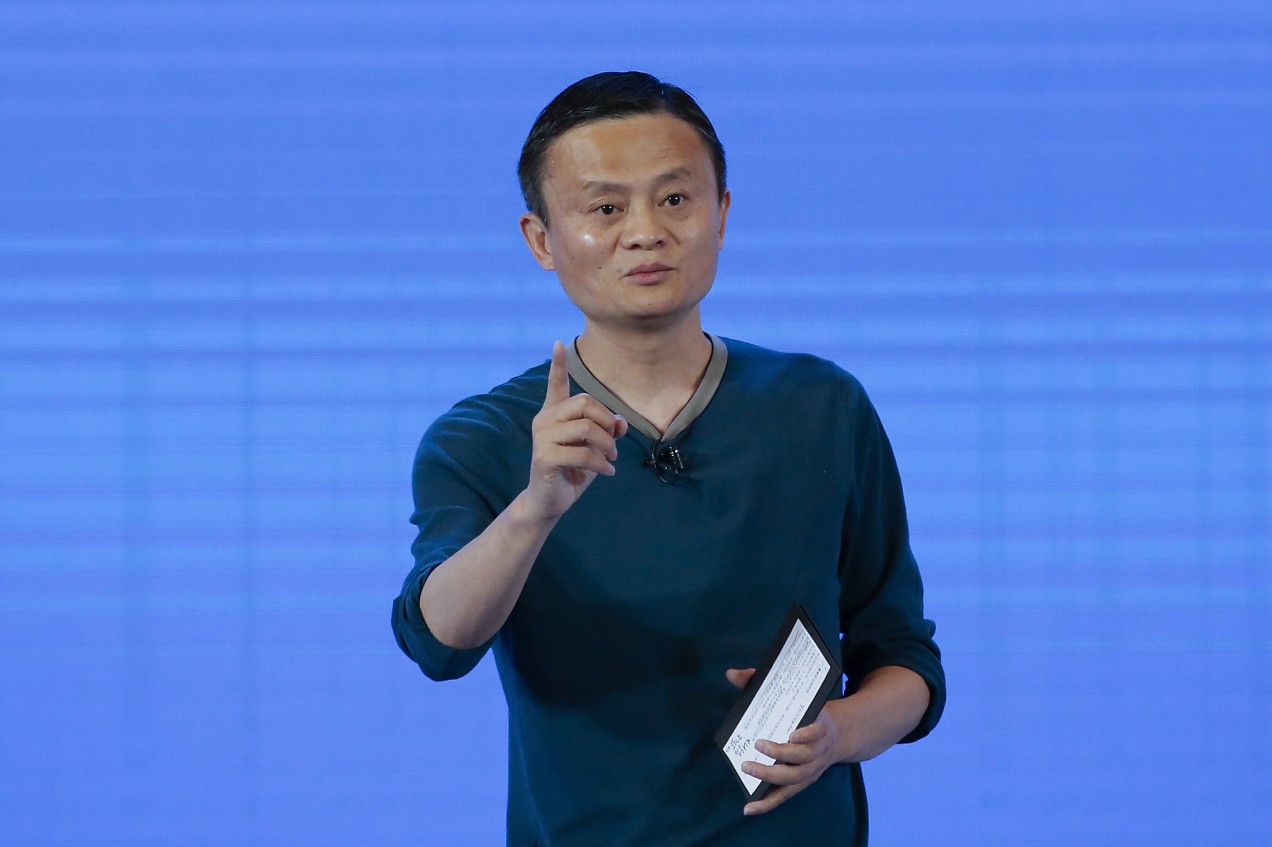

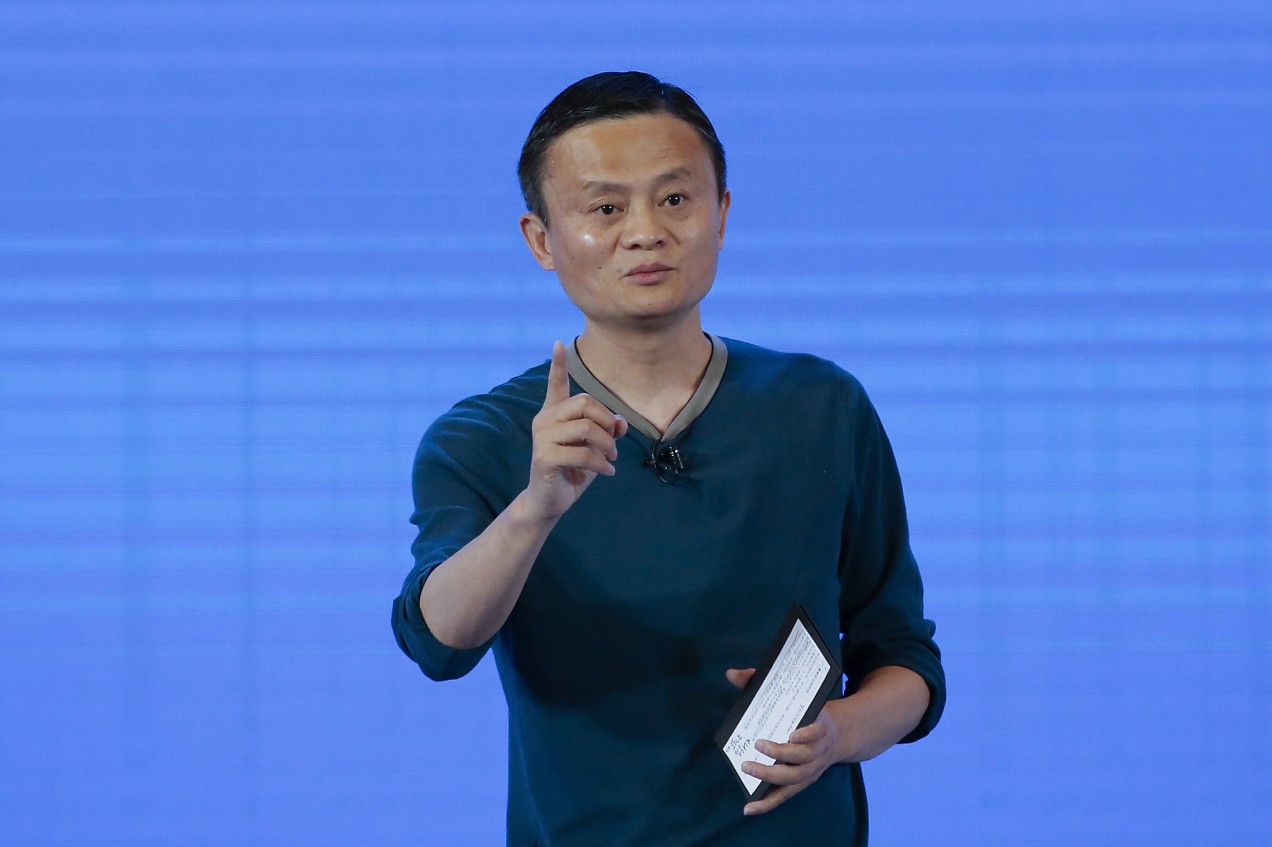

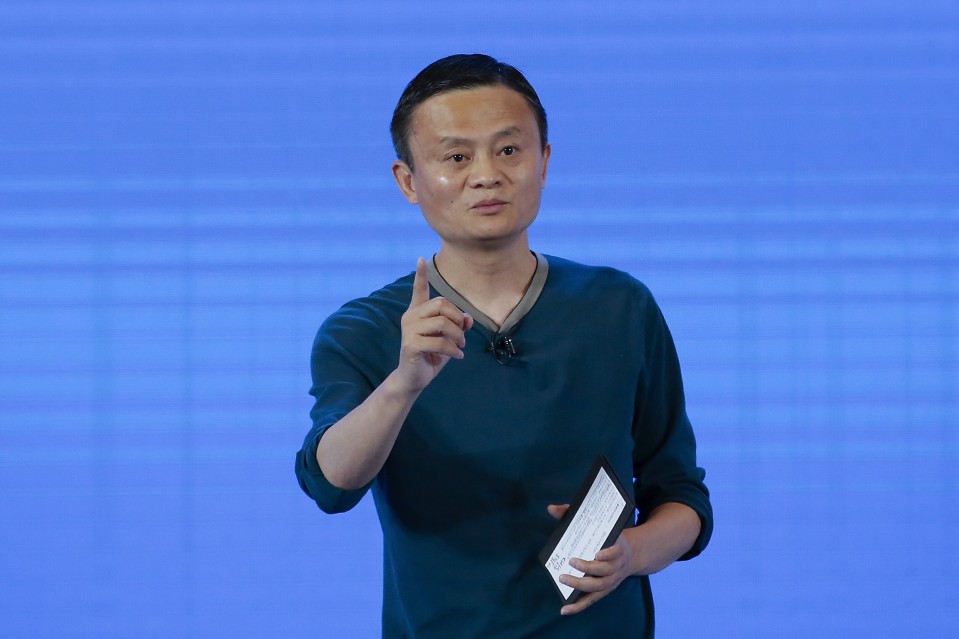

The giant e-commerce platform Alibaba and its charismatic founder, Jack Ma, have a plan to add a million U.S. jobs by enticing American companies to sell to China.

Last week Jack Ma, the executive chairman of the online-commerce company Alibaba, went to Detroit to convince Americans that China and e-commerce could save small businesses. The Chinese billionaire paced around a huge stage, TED talk–style, trying to inspire U.S. entrepreneurs to strive for greatness. Alibaba is not known for subtlety or understatement, and the event did not disappoint. Charlie Rose and Martha Stewart appeared onstage, as did a group of drummers suspended in midair.

Ma is right, in least in theory, to urge these businesses to consider China. By 2015, China’s online retail market was the largest in the world—80 percent bigger than that of the United States. Cross-border consumer e-commerce was valued at $40 billion. The opportunity is expanding. Within five years there could be more than 600 million people in China’s middle class. And thanks to the Internet, it’s easier than ever for U.S. companies to reach them.

Just ask Veronica Pedersen, CEO of Timeless Skin Care, a family business based in Rancho Cucamonga, California. Timeless, which sells anti-aging serums and creams, works with a distributor to sell products to China on Alibaba’s Taobao Global shopping site. Last year Timeless brought in just under $5 million in revenue, according to the company, with sales in China accounting for more than half of that. Pedersen refers to her company as “mom-and-pop e-commerce.” Timeless, which has around 20 employees, is not aiming to conquer China. “If you are able to tap 1 percent of the Chinese market, you’re in business,” Pedersen says.

Alibaba claims to be the world’s largest retail commerce company, with annual revenue of nearly $23 billion. Last year, American goods ranked number two for imported products on Alibaba’s Tmall marketplace. Best-selling product categories include apparel, fresh food, mother and baby products, health supplements, and electronics. Many Chinese consumers are tired of worrying about food and product safety. They don’t want fake vitamins or dangerous baby products, and a U.S. label can signal quality. “The Chinese consumer is much more aware than American consumers of where everything is manufactured,” says Pedersen. “Our strategy in the Chinese market is about ‘Made in the USA.’”

Timeless is one of a handful of success stories that Alibaba showcased at its Gateway ’17 event in Detroit. The conference, which had some 3,000 attendees, was targeted at owners of small and medium-size businesses, as well as farmers, who want to learn more about how to sell their products to China. Keynotes and breakout sessions celebrated the Chinese opportunity and offered tips on how to sell on Alibaba.

Earlier this year Ma had told President Donald Trump that he intended to create a million U.S. jobs, and the event was a step toward fulfilling that promise. “If we can help one million small businesses online and each small business can create one job, we can create more than one million jobs,” Ma said in Detroit.

Getting all those small U.S. businesses onto Alibaba won’t be easy, and not for the reasons you’d think. Neither the Chinese nor the U.S. government is posing the biggest obstacles to Ma’s vision, at least for now. Instead, one of Alibaba’s key challenges will be to change the way Americans think about China—and about themselves. Americans will need to view China as a market and the U.S. as a seller, rather than the other way around. “U.S. companies have had the luxury of having a strong local market,” said Joshua Halpern, director of the eCommerce Innovation lab at the U.S. Department of Commerce. “So after building a brand in the U.S. your first step out of your house is not going to be to the largest, most challenging market in the world.”

Some of the small businesses at the conference seemed a little daunted. One attendee was Will Gee, CEO of Balti Virtual, a roughly 10-person Baltimore company that makes temporary, augmented-reality tattoos. Gee said the Alibaba conference opened his eyes to the possibility in China, as well as to “how complex an opportunity it is.” There’s “just so much to navigate,” he said, with details to figure out regarding “international trademarks, copyrights, all these different pieces of our business that I hadn’t really thought of as a small-business owner.” At the end of the conference, Gee was still open to exploring Alibaba, just not immediately.

The elephant in the conference center was the counterfeiting issue, which Ma himself referred to as a “cancer” that could kill his business. It’s unclear how many Americans are even aware of Alibaba, but those who are may have heard horror stories about small businesses hurt by Chinese fakes. Alibaba claims to be cracking down by getting companies to trademark their products before going on Tmall, responding quickly to reported violations, using algorithms to root out counterfeits, and showing zero tolerance for intellectual-property violations. What’s clear is that if Alibaba wants to succeed in the U.S., it will have to get this problem under control.

Counterfeits are not the only challenge. Chinese consumers may like American products, but that doesn’t meant any U.S. product will sell. It helps if a brand has demonstrated success in its home market. Timeless Skin Care, for example, was highly rated on Amazon before venturing into China.

Alibaba likes to promote its staggering numbers—$547 billion in gross merchandise volume, 1.5 billion product listings—but those figures cut both ways. How does a small operation make a mark on such a massive platform? The answer is by making a significant investment, particularly in marketing. It’s important, for example, to tell Chinese consumers the story behind your brand. Frank Lavin, CEO of Export Now, which operates Chinese e-commerce stores for international companies, says one big mistake that U.S. companies make is thinking that they can just “show up” in China.

Nor can a U.S. company afford to go it alone, at least right now. Last year Stadium Goods, a consignment sneaker business based in New York, started selling on Tmall Global, Alibaba’s cross-border e-commerce platform. John McPheters, CEO and cofounder of the company, says that China makes up 10 to 15 percent of its online business. Like other U.S. companies that sell on Tmall, Stadium Goods works with a third party (theirs is called Magic Panda) that handles things like customer service, marketing, logistics, and management for the brand’s Tmall storefront. McPheters has come to appreciate the power of Chinese social media. When I visited the Stadium Goods store in the SoHo neighborhood of New York City a week before the event, there were people broadcasting to online platforms in China. McPheters says that Stadium Goods has fewer than 50,000 followers on the microblogging service Weibo, but he has heard stories from China about “people that have relatively small following counts that can drive huge amounts of sales.” In the U.S., not so much. Stadium Goods has over 330,000 followers on Instagram, McPheters says, and if you post a photo, “you might sell a shoe or two.”

Truly succeeding on Tmall requires understanding the Chinese consumer mind-set. Customers may be willing to pay more for quality products, but they still love a good deal. McPheters says there’s a “video game” element to transactions in China, with an emphasis on coupons, discounting, and rewards that goes far beyond what you see in the U.S.

Skeptics will wonder if Alibaba’s small-business push is primarily a way to please Trump and build goodwill for the Chinese company’s U.S. ambitions. Alibaba’s payment affiliate Ant Financial, for example, is currently seeking to buy MoneyGram, an American payment processor. Ant Financial operates Alipay, a mobile payments system that has hundreds of millions of customers. (See, Meet the Chinese Finance Giant That's Secretly an AI Company.)

But Alibaba claims that its customers want products from smaller businesses because big brands alone no longer satisfy China’s aspirational class. Consumers “no longer buy in the traditional, massive consumption model,” says Alibaba Group vice president Jet Jing. “They want something which represents their taste and their style.”

Small businesses already boost Alibaba’s bottom line, says Michael Zakkour, a vice president at the consulting firm Tompkins International, one of the sponsors of the Detroit event. “The reason Alibaba is going after small businesses globally is because their biggest money maker is Taobao, which is a marketplace for small businesses and individual merchants,” Zakkour says.

Ma says that Alibaba already has millions of small businesses using its online services, and that the company has already created more than 33 million Chinese jobs. The question is whether it can replicate this model in the U.S.. Companies that are doing well on Alibaba, like Timeless, claim to have already added staff to meet Chinese demand. The potential is there: America has a lot of things that Chinese people want to buy. Now Alibaba will have to persuade more small companies that the rewards of the Chinese market outweigh the risks.

Emily Parker has covered China for the Wall Street Journal and been an advisor in the U.S. State Department. She is the author of Now I Know Who My Comrades Are: Voices from the Internet Underground.

Advertisement