Business Impact

Innovation in Manufacturing Takes a Village

For expensive manufacturing research on solar panels and 3-D printing, a new push toward shared pilot production facilities.

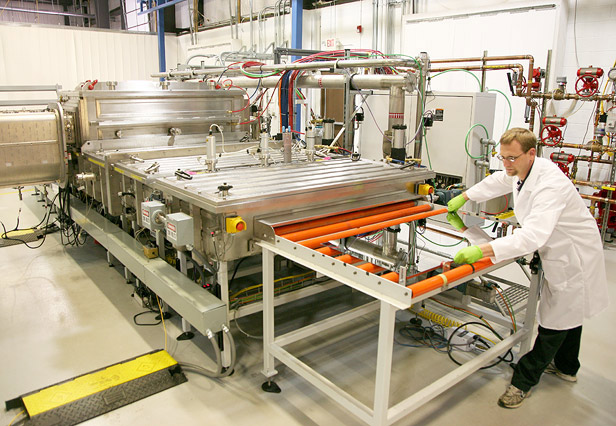

Inside an 18,000-square-foot warehouse in Halfmoon, New York, a town north of Albany, a researcher gingerly lifts a photovoltaic cell from an oven, its glass backing shimmering with an ultrathin coating of exotic metals.

This particular solar technology—based on a material called copper indium gallium selenide (often called CIGS)—is a clear underdog in the marketplace. With a supply glut depressing the price of panels made from crystalline silicon, the dominant technology in solar, CIGS is still too expensive per watt of output to compete (see “The Bright Side of a Solar Industry Shakeout”).

With improvements in efficiency and refinements in production methods, CIGS technology could still be a potential option for renewable energy, at least in some applications. But the facilities needed to get there are enormously expensive. The production facility in Halfmoon—which can turn out a modest 100 kilowatts’ worth of CIGS solar cells a year—is crucial for testing whether new advances in materials can translate into reliable and affordable commercial production. Such production lines, depending on their configuration, can cost between $10 million and $50 million.

That’s way too much for a tiny CIGS company such as Magnolia Solar, based in Woburn, Massachusetts. The company’s entire market capitalization is now just $3 million, following a 90 percent plunge in its stock price in the past two years as prices for solar panels have fallen. “There is no way we could afford this on our own,” says Ashook Sood, the company’s CEO.

Companies like Magnolia and many others can persist because the costs at Halfmoon are shared across the industry. Under the auspices of the Photovoltaic Manufacturing Consortium, located at the College of Nanoscale Science and Engineering, the pilot-scale production line is shared by some 40 companies and backed by a $57 million grant from the U.S. Department of Energy. And the line is slated to expand its annual production to make enough panels to generate 20 megawatts of solar power. “We have access to this excellent solar-cell facility without the capital outlay,” Sood says.

As a recent White House report spelled out, American ideas sometimes fail to get commercialized because companies, especially smaller ones, can’t afford the big, risky investments needed to sort out how to produce their inventions (see “Can We Build Tomorrow’s Breakthroughs?”). Product ideas that originated in the United States but ultimately were manufactured in other countries include flat-panel TVs, lithium-ion batteries, and e-readers.

To close the gap, the Obama administration has launched a campaign to restore U.S. preeminence in high-tech manufacturing. Its centerpiece is a $1 billion plan for 15 new manufacturing institutes.

“The idea is to create facilities that benefit entire sectors, not pick winners or losers,” says Michael Molnar, chief manufacturing officer of the National Institute of Standards and Technology, in Bethesda, Maryland, who also heads a White House task force on advanced manufacturing. “It’s something no single company or university or group would be able to do themselves.”

As a start to this effort, the U.S. Department of Defense this year set aside $30 million to create an additive manufacturing institute in Youngstown, Ohio; it will host 3-D printing technologies that build objects layer by layer. The Ohio effort, which launched in August, has had a strong start: initially it had 62 participants, but the number has swollen to 132 companies and research groups in materials, lasers, and 3-D software.

The hope is that the institutes will repeat the success of Sematech (see “Lessons from Sematech”), the semiconductor R&D organization created in the 1980s to help U.S. firms compete against Japanese computer-chip manufacturers (it is now a partner in the photovoltaic consortium). Research by a group of 14 companies, including Intel, was heavily subsidized by the government at first, but it is now entirely funded by its members, says Michael Idelchik, vice president for advanced technology at General Electric. “I would claim this created one of the most efficient research ecosystems in the world,” he says.

Idelchik believes that the collaborative model can “prosper and accelerate” in other areas, including flexible electronics, carbon-fiber composites, and even another thin-film solar technology based on a material known as cadmium telluride (GE recently delayed production of its own solar panels using this technology until market conditions improve). GE is particularly interested in 3-D printing, which is gradually becoming a commercially viable way to manufacture industrial parts.

“Transitioning this industry from a prototyping industry into production capabilities is the future,” Idelchik says. “Whatever country takes it on and drives it as a national priority will win.”