Business Impact

Tilting at Oil Rigs

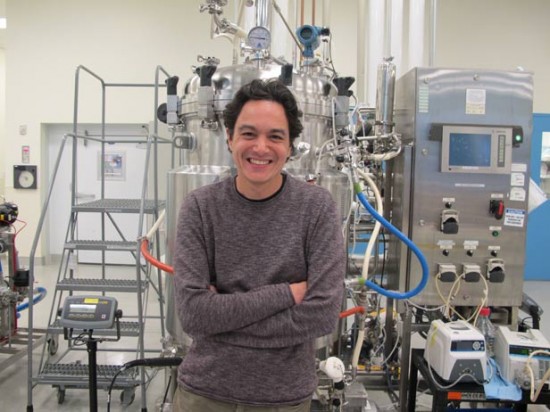

Neil Renninger led a wave of young entrepreneurs who are finding energy problems harder to solve than they thought.

As an undergraduate in the mid-1990s, Neil Renninger was part of an MIT blackjack team that won millions at casinos by using card counting to beat the house. Yet the stakes were low compared with what he tried next: he cofounded Amyris, a synthetic-biology company that attempted to take on the oil companies by making biofuels.

For now, the luck seems to be with the oil companies. Advanced-biofuels companies like Amyris, which has engineered yeast to make a hydrocarbon that’s a replacement for diesel, were supposed to have been producing hundreds of millions of gallons of fuel by now. But that is proving far more difficult—and more costly—than they imagined. Some, such as Range Fuels, have run out of funding and filed for bankruptcy.

Earlier this month, Amyris also said it would all but exit the fuel business and focus on making low-volume specialty chemicals like moisturizers. “We did well playing blackjack. We’d easily win well into the seven digits as a team,” says Renninger, who is chief technology officer of Amyris. “But fuels and chemicals are a multitrillion-dollar business.” The scale is different by “orders of magnitude,” he says.

Some green energy companies, like competitors LS9 and Gevo, battery maker Seeo, and electric-car maker Tesla Motors, were started or staffed by young engineers from schools like Stanford and MIT, who resolved to apply their talents to challenges such as climate change rather than heading to the pharmaceutical industry or Wall Street. By the mid-2000s, enthusiastic students were swelling enrollment in undergraduate energy courses, while the U.S. Department of Energy was putting out calls for “the best and the brightest … to transform the global energy landscape.”

Renninger, a chemical engineer and biologist, was at the leading edge of the wave. Amyris got off the ground with big, change-the-world ambitions. The company’s first project was genetically engineering microörganisms to make a malaria drug, something that promised to save tens of thousands of lives. “We were not paying people well,” says Renninger. “People came on board because they were inspired by the impact that they could have with their science.”

For an encore, the company settled on an even more ambitious target: making biofuels at a scale large enough to challenge petroleum consumption. “We could have said our next product was going to be strawberry flavoring. That wouldn’t have been exciting to the troops at Amyris,” says Renninger. “It would have been wholeheartedly rejected. Because at the end of the day, who cares if you made a better strawberry flavoring?”

Yet after about seven years of biofuel development, Amyris is now asking its employees to do essentially that. The company announced that it would direct attention away from biofuels and toward relatively low-volume products such as squalane, a moisturizer for cosmetics, as well as oils for flavors and fragrances and industrial chemicals such as an additive for plastic bottles.

Renninger says Amyris hasn’t given up entirely on making fuel. The company has managed to manufacture biofuels in low volumes; about 150 buses in one Brazilian city run on its products. But the buses require only hundreds of thousands of liters of fuel a year, and it would take billions of liters to make an impact in the fuel industry, says Renninger. The company is now counting on partners Total (the French oil firm) and Cosan (a Brazilian ethanol and gas company) to build larger biofuel plants. “The amount of capital you need for one billion liters’ worth of capacity is huge,” says Renninger. “We want to leverage somebody who has a balance sheet that allows it to access capital at a low cost. That’s not us at this point.”

Amyris still needs to demonstrate that its process works economically at a new 50-million-liter plant the company is building this year. It hopes it can sell fragrances and specialty chemicals at higher prices than it could command for biofuels, potentially making low-volume production profitable. That’s a risky strategy—the specialty chemicals industry is highly competitive. And production of even a few million liters of product using microörganisms can be challenging. Last year, issues such as power shortages and contamination left Amyris struggling to achieve high enough yields at one of its contract manufacturing facilities.

In the meantime, the company also needs to keep the troops interested in products that don’t have the world-changing potential of biofuels. Some employees have taken up squalane as an environmental cause; the chemical is usually produced from shark livers. To drum up interest in developing the synthesized version, they passed out “save the sharks” fliers in the Amyris labs.

Renninger, who helped dream up Amyris over Thai takeout and bottles of wine a decade ago, says the company wouldn’t have gotten off the ground if he and his cofounders had based it in on making moisturizers. But to him, the story isn’t over. “We view squalane as just a step along the way,” he says. “Is it important in its own right? Yes. Is it what we want to be remembered for? No. The goals are much loftier than that.”